The Federal Reserve just made a big move by cutting interest rates by 0.50%, the largest cut in four years.

Usually rate cuts are good news for riskier investments, including cryptocurrencies. When rates are low, investors often look for better returns in assets like Bitcoin instead of traditional savings or bonds.

This has many people wondering: could we be on the brink of another crypto bull market?

Let’s take a look at past rate cuts and how markets responded.

This could give us a better idea of how Bitcoin and crypto will perform, and how long we should hold out for.

A Quick Look at Past Rate Cuts

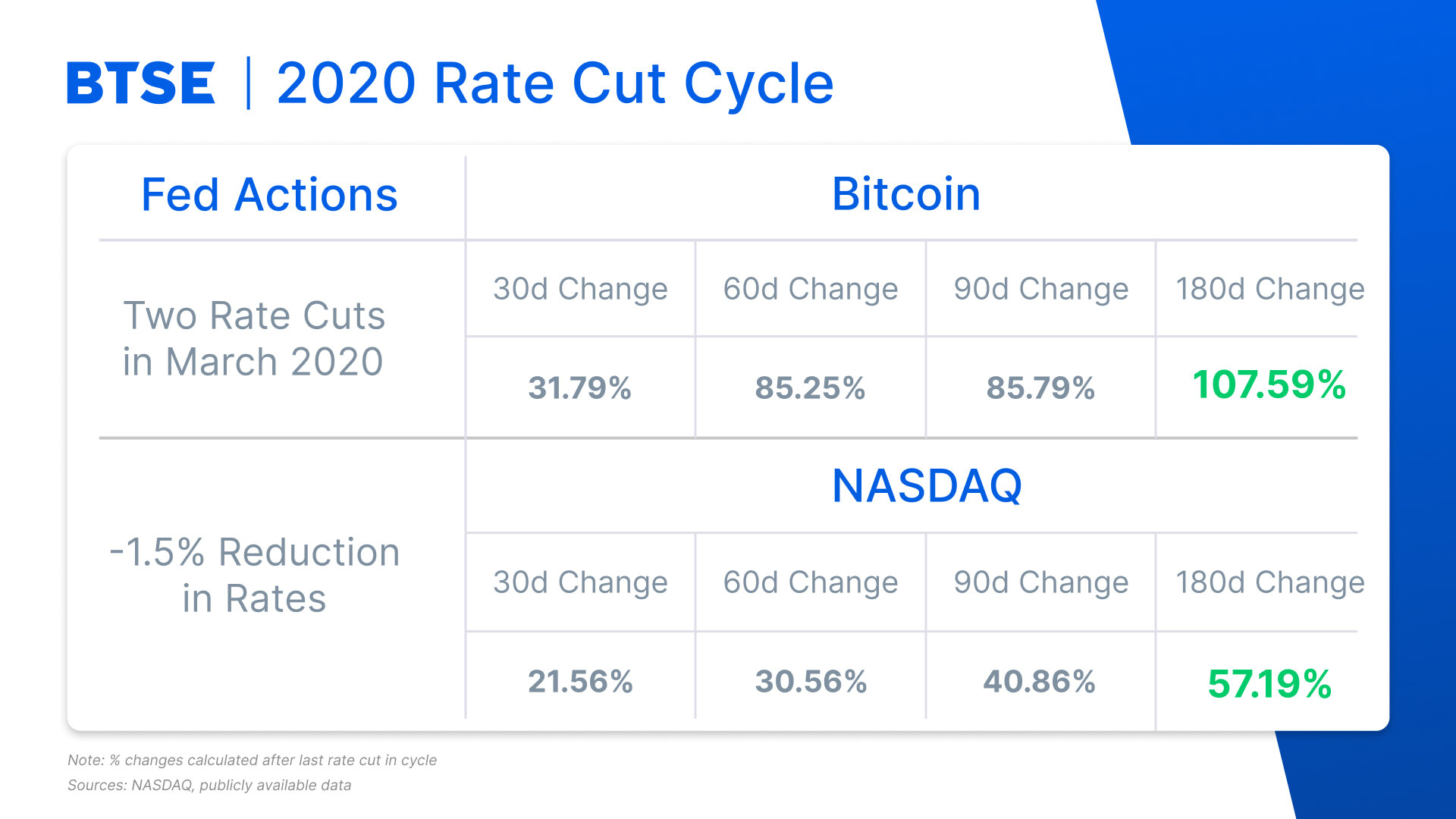

2020: COVID-19 Response

The last time the Fed cut rates was in March 2020, when the COVID-19 pandemic hit and the Fed slashed rates by 1.5%. This led to a quick rebound for Bitcoin, which jumped 32% in just thirty days and doubled in price after six months.

The NASDAQ also saw a strong recovery, going up by 57% in the same time frame. This shows that rate cuts can boost market confidence even if it takes a while for the overall economy to feel the effects.

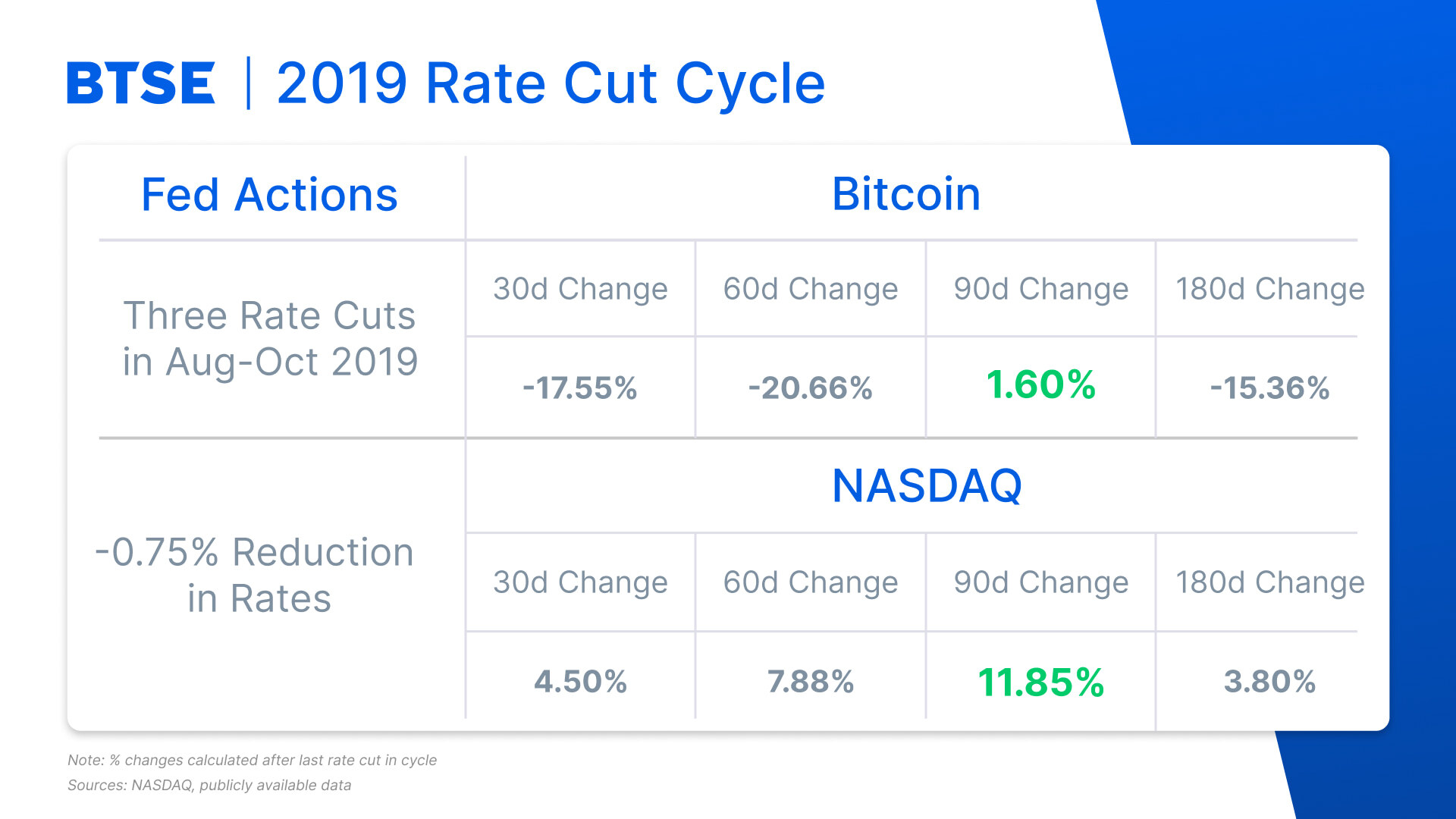

2019: Mid-Cycle Cuts

In mid-2019, the Fed cut rates by 0.75% for the first time in over a decade. This was during a time when many were worried about slowing economic growth.

Interestingly, Bitcoin didn’t react well initially and dropped by 20% over two months. Meanwhile, the NASDAQ rose steadily after the cut. This highlights that sometimes, Bitcoin can be influenced by factors beyond just interest rates.

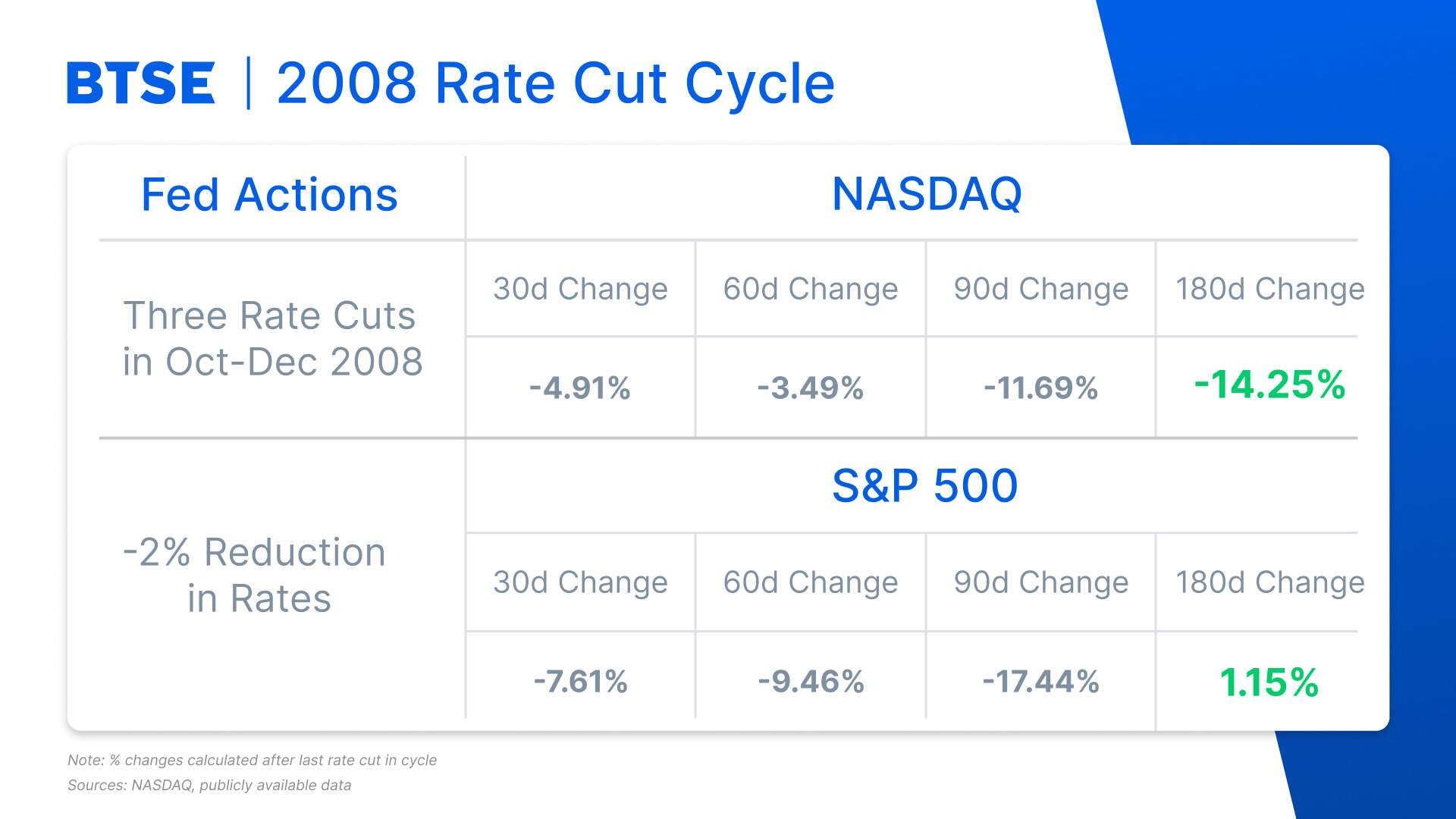

2008: The Financial Crisis

During the financial crisis in late 2008, the Fed cut rates dramatically to help stabilize the economy.

Initially, markets continued to drop even after the cuts, but six months later, they started to recover.

This period was unique due to the severity of the crisis, which could explain why it took longer for markets to recover.

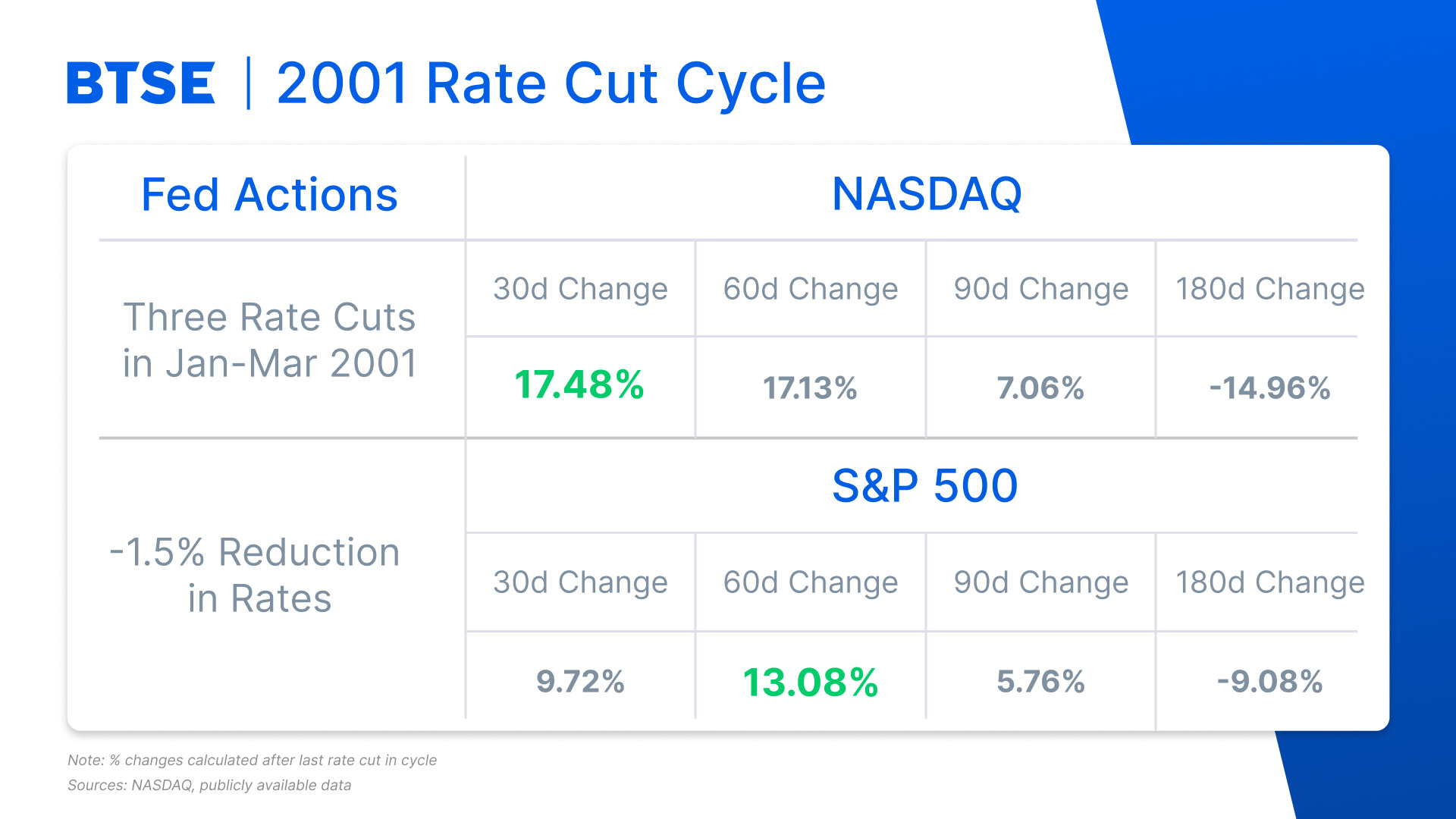

2001: After the Dot-Com Bubble

In early 2001, following the dot-com bubble burst, the Fed cut rates three times. The markets reacted positively at first, with NASDAQ jumping significantly.

However, external events like the September 11 attacks caused major drops later on.

What Does This Mean for Crypto Now?

So, what can we expect now that rates are lower? Generally speaking, lower interest rates tend to attract investors to riskier assets like Bitcoin because they’re looking for better returns.

However, not everyone is convinced this will lead to immediate gains. Some experts warn that if people see these cuts as a sign of economic trouble, it could lead to short-term declines instead.

The data makes it clear, however, that the longer you hold risky assets, the more likely you are to see a positive return. In most rate cut cycles, Bitcoin and/or stocks saw strong raw returns after three or six months.

Conclusion

While there’s potential for a bull market in crypto following this rate cut, it’s essential to keep an eye on how other factors—like economic conditions and investor sentiment—play out.

If you’re considering investing in cryptocurrencies right now, remember that while lower rates can boost prices, they can also lead to volatility and uncertainty.

In short: keep your eyes peeled and do your research before making any big moves!

For other industry insights, click here.

Our aim is to create a platform that offers users the most enjoyable trading experience. If you have any feedback, please reach out to us at support@btse.com or on X @BTSE_Official.

Disclaimer: BTSE blog content is intended solely to provide varying insights and perspectives. It does not constitute financial, legal, or investment advice and should not be relied upon as such. The views expressed are not necessarily those of BTSE. Unless otherwise noted, they do not represent the views of BTSE and should in no way be treated as investment advice. Trading involves substantial risk due to market volatility, and past performance is not indicative of future results. Always trade with caution and consider seeking advice from a qualified professional before making any financial decisions.